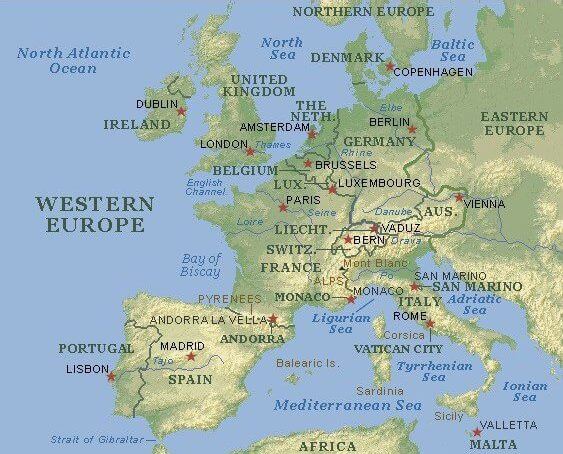

Western Europe Printer and Hardcopy Markets Shows Good Gains in Fourth Quarter, Reports IDC

Western European printer and MFP shipments kept up the momentum and recorded positive year-on-year results for fourth-quarter 2013, according to latest figures from International Data Corporation (IDC). The market increased 5.5% year on year to 6.94 million units, which is an increase of around 360,000 units compared with the same period in 2012. However, price pressure has led to strong ASV declines and the recorded year-on-year value fell 7.4% to $2.92 billion.

Western European printer and MFP shipments kept up the momentum and recorded positive year-on-year results for fourth-quarter 2013, according to latest figures from International Data Corporation (IDC). The market increased 5.5% year on year to 6.94 million units, which is an increase of around 360,000 units compared with the same period in 2012. However, price pressure has led to strong ASV declines and the recorded year-on-year value fell 7.4% to $2.92 billion.

Overall this shows a positive trend, and both laser and inkjet markets showed growth in some segments. Laser markets remained flat for the quarter while inkjets showed growth in the traditionally strong quarter as both consumer and business markets increased.

2013 started off with a very weak quarter in first-quarter 2013, but markets improved toward the end of the year, and as a result 2013 growth was flat; when considering that some countries still have economic and political issues the result can be looked at favorably.

Phil Sargeant, program director of IDC’s Western European Imaging Hardware Devices and Document Solutions group, said, “These positive results for the quarter show that many companies are continuing to invest in their printing and imaging requirements as confidence in the overall economy improves. There are pockets of opportunities for many manufacturers and channel partners, and 2014 is most likely to see the overall market increase. Growth is likely to be steady rather than spectacular.”

Main Highlights

- The overall Western European hardcopy market increased year on year by 5.5% in fourth-quarter 2013, with gains in both ink and laser markets.

- Total inkjet markets increased 2.6% in the fourth quarter of 2013 from the fourth quarter of 2012. Consumer inkjet markets showed growth of 8.6% in the traditionally strong quarter and business inkjets increased 2.9%, following on from very strong growth in third-quarter 2013.

- The overall laser markets were flat, which is not surprising as markets were very strong in third-quarter 2013, and some stock remained in the channel.

- Both color and monochrome markets were flat as a result and the growth came from MFP products, though printer shipments declined; printer products still outsold MFP products by more than 2:1 and remain a large opportunity market.

- Serial impact dot matrix markets declined year on year by 32.7%.

- Labels and packaging production markets showed year-on-year growth of 30.3%.

Country Highlights

Germany:

The German market increased year on year by 2.7%. Inkjet markets in the fourth quarter showed growth of 7.0% but laser markets contracted 4.0%. Shipments of laser products mirrored those of the Western European market with both color and monochrome MFP markets increasing year on year, but printer shipments declined. Most areas of the MFP market increased, but A4 color MFP products fell back slightly while A4 monochrome MFP increased by double-digits. Overall the 2013 market in Germany increased 0.5%.

France:

The French market saw greater increases than in Germany with unit shipments increasing year on year by 8.6%. Both inkjet and laser markets increased by over 9%. Consumer inkjet markets increased 8.8%, while business inkjets showed the most growth at 13.8%. Laser shipments were very positive and all printer and MFP products increased, with color MFP products increasing by over 21.0% in the fourth quarter of 2013 compared to the fourth quarter of 2012. For laser products the only segment not to show growth was A3 monochrome printers, a market which is in decline. The overall French market showed slight growth of 0.5% in 2013.

United Kingdom:

In the fourth quarter of 2013 the U.K. market increased 13.4% compared to the fourth quarter of 2012. Inkjet shipments increased 14.7% and in contrast to other countries business inkjets showed a decline, but consumer inkjets were much stronger, having been quite weak in previous quarters. Color MFP markets showed very strong growth with both A4 and A3 achieving double-digit year-on-year growth. The U.K. market remained flat in 2013 and remained the third-largest market in Western Europe.

Notes:

- Source: IDC Worldwide Quarterly Hardcopy Peripherals Tracker, February 2014.

- All growth rates quoted are year on year (fourth-quarter 2013 versus fourth-quarter 2012).

- IDC tracks A2–A4 devices in the Quarterly Hardcopy Peripherals Tracker.

- Hardcopy peripherals include single-function printers, printer-based multifunctional systems (MFPs), and single-function digital copiers (SFDCs). Data is reported for calendar periods.

- For more information about IDC’s Worldwide Quarterly Hardcopy Peripherals Tracker in EMEA, please contact Phil Sargeant (psargeant@idc.com).

You must be logged in to post a comment.