IDC: Western Europe Printer, MFP Shipments Show Slight Decline, Business Inkjets Make Gains

February 17, 2015 — According to research by International Data Corporation (IDC), the Western European printer and MFP market showed a slight decrease in terms of unit shipments of 0.8 percent when compared to the same period a year ago, as consumer-inkjet shipments contracted. This resulted in a fourth-quarter 2014 (Q414) market figure of 6.84 million unit shipments, and represents a unit-shipment decline of 52,000 units. On a more positive note, however, revenues increased as more high-speed laser MFP laser and business inkjets shipped.

February 17, 2015 — According to research by International Data Corporation (IDC), the Western European printer and MFP market showed a slight decrease in terms of unit shipments of 0.8 percent when compared to the same period a year ago, as consumer-inkjet shipments contracted. This resulted in a fourth-quarter 2014 (Q414) market figure of 6.84 million unit shipments, and represents a unit-shipment decline of 52,000 units. On a more positive note, however, revenues increased as more high-speed laser MFP laser and business inkjets shipped.

Note that IDC tracks A2–A4 devices in its Quarterly Hardcopy Peripherals Tracker. Hardcopy peripherals include single-function printers, printer-based multifunctional systems (MFPs), and single-function digital copiers (SFDCs).

However, according to its latest Worldwide Quarterly Hardcopy Peripherals Tracker report, IDC says the overall hardcopy market in Western Europe did recover in 2014, and combined printer and MFP shipments increased by 2.9 percent for the year and, as with recent trends, the switch from single function to MFP continued in most major segments.

As with Q414, MFP products accounted for 82.4 percent of all shipments. The overall MFP market increased by a minimal 0.6 percent, while printers continued to decline at -6.5 percent. While the laser market showed an overall slight 0.6 percent year-over-year decrease, laser MFPs showed the most growth, at 8.3 percent, with an impressive 17.3 percent for color devices and a more modest 1.6 percent for mono. While the A3 laser market showed a slight increase, the overall A4 market showed a decline of almost 1 percent, indicating the continued threat from business inkjets.

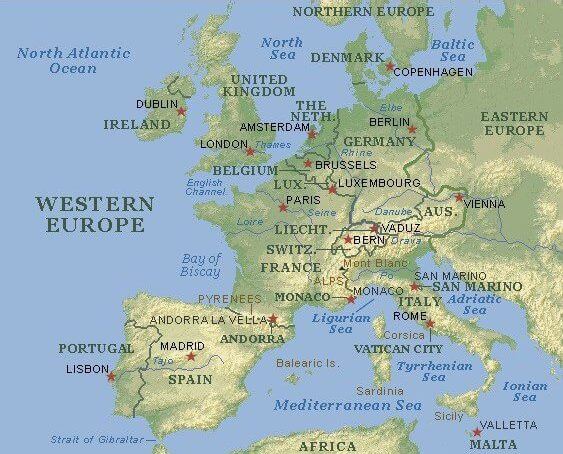

While the overall market showed a small decline in Q414, the trend by country is more pronounced with a double-digit decrease in the Nordic countries. More positive trends are observed in Germany, Italy, and the Netherlands.

Business inkjet remains successful, with a 46.1 percent year-over-year increase and MFPs showing the highest growth rates. Germany alone represents 39 percent of the business-inkjet market, followed by France and the United Kingdom.

“While the inkjet segment has been associated for a long time with the consumer market, business inkjet proved to be a game changer, with excellent growth for the past seven quarters. It is a real alternative to laser and is slowing the decline of the inkjet market,” said Delphine Carnet, senior research analyst in IDC’s Western European Imaging Hardware Devices and Document Solutions group.

According to IDC:

- The overall Western European hardcopy market declined year on year by 0.8 percent in Q414,

- While the laser market showed a small decline, color devices saw a significant 10.0 percent growth compared to Q413.

- Most of the color growth was again from A4 MFP products, while color printer products declined and a similar pattern occurred with monochrome devices.

- Business inkjet performed very well this quarter, with 51.0 percent growth for MFPs, while printers saw a more modest 15.9 percent growth.

- High-speed color-laser equipment showed excellent growth, largely due to the increase in market revenues.

Country Highlights

Germany

The German market increased by 6.0 percent year-over-year in Q414, which is a very different trend than the Western European average. Business-inkjet markets were very strong and increased year on year by 61.6 percent, while other types of inkjet devices actually decreased by 5 percent.

The laser market in Germany did show some growth and this was actually due to color, while monochrome showed a negative trend. Both single and MFP markets increased, with most gains due to business inkjets and color laser devices. Monochrome shipments contracted sharply, especially printers, while MFP shipments slightly increased year-over-year.

France

In contrast to German growth, shipments in France in Q414 contracted by 3.6 percent when compared to the same period last year. Inkjet demand remained flat while laser markets decreased 13.1 percent. The consumer markets for inkjet showed a small decline but there was actually a solid increase of 26.9 percent for business inkjets in France, but increases were not enough to counteract the declines seen in consumer markets. Surprisingly, single function inkjet shipments saw a 12.9 percent increase while both inkjet and laser MFPs decreased.

United Kingdom

The United Kingdom recorded an 8.6 percent decline and in sharp contrast to Germany the United Kingdom saw year-over-year decreases in both inkjet and laser markets. As a result the United Kingdom lost his rank from the second to third largest market in Western Europe. More positively, the United Kindgom enjoyed a very good performance in the business-inkjet segment with a 26.3 percent increase. Laser markets decreased 7.6 percent when compared to the same period last year, with growth only being seen with color MFPs. Laser printers continued to decline with double digit declines being registered.

For more information about IDC’s Worldwide Quarterly Hardcopy Peripherals Tracker in EMEA, contact IDC’s Phil Sargeant (psargeant@idc.com).

More Resources

- February 2015: CONTEXT: HP IS BUSINESS-INKJET MARKET LEADER IN WESTERN EUROPE

- November 2014: WESTERN EUROPE PRINTER AND MFP SHIPMENTS STABLE, BUT REVENUES UNDER PRESSURE, REPORTS IDC

- October 2014: LASER AND INKJET PRINTER AND ALL-IN-ONE SALES UP THREE PERCENT IN WESTERN EUROPE

- August 2014: IDC: WESTERN EUROPE PRINTER/COPIER/MFP MARKET CONTINUES TO STRENGTHEN

- July 2014: OEM TONER-CARTRIDGE REVENUES INCREASE IN WESTERN EUROPE

- June 2014: PRINTER SHIPMENTS UP NINE PERCENT IN WESTERN EUROPE, REPORTS CONTEXT

- May 2014: GROWTH IN WESTERN EUROPE PRINTER, MULTIFUNCTIONAL MARKET CONTINUES INTO FOURTH QUARTER

- April 2014: LASER MFP SALES SHOW HEALTHY GAINS IN WESTERN EUROPE

- February 2014: WESTERN EUROPE LASER MFP SALES SHOW EIGHT PERCENT INCREASE

- February 2014: WESTERN EUROPE PRINTER AND HARDCOPY MARKETS SHOWS GOOD GAINS IN FOURTH QUARTER, REPORTS IDC

- November 2013: WESTERN EUROPE PRINTER, MFP, COPIER MARKET CONTINUES TO RECOVER, REPORTS IDC

You must be logged in to post a comment.